The Biggest Threat To Your Portfolio

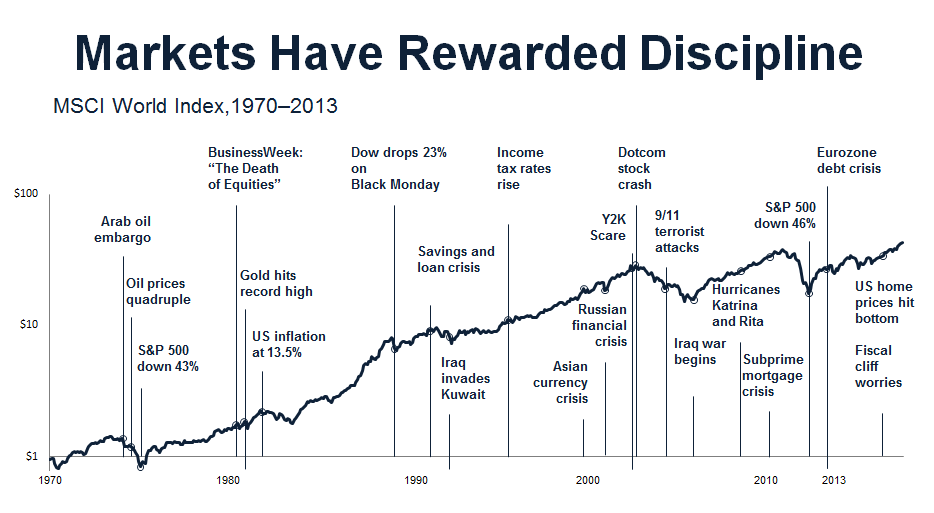

The Biggest Threat To Your Portfolio is a well-written piece by Josh Brown at The Reformed Broker who highlights that all of the current noise going around in the financial markets such as Greece, China, or the Federal Reserve is not the biggest enemy of your portfolio. The biggest threat to your portfolio is you.Brown notes in his article, "Your emotions and the actions you take during times of increased volatility or drawdown will ultimately have more impact on your long-term returns than any exogenous thing that may come along."Within the past 3 months, we have seen more volatility in the portfolios that we manage at TAMMA than I can recall in the past 3 years. When I say volatility I am talking about the good and the bad. A stock that balloons up 10% and another one that comes crashing down 10%. This roller coaster ride is also getting the attention of clients (those who do look at their portfolios, as many do not) recently started asking a few more questions about what was going on. My advice to them was to simply stop looking. Reviewing your portfolio once a month or quarterly is probably all that you would want to do. Looking at your positions more than could trigger the emotions that Josh noted above that could end up doing serious harm to our portfolio and financial goals.I agree with Brown when he went on to say that whatever the next big thing to hit the financial markets is not what is on the front pages of the newspaper today. Brown went on to say "we still cannot pinpoint the events that have marked previous market tops even in hindsight."Another piece of advice that Brown shared was this, "Having a plan in place that’s been crafted in advance – and not just any plan but a damn good one – is superior to any kind of insurance one can buy after the fact. Plans should be agreed upon and adopted during times of clarity and sanity, never under duress. And most importantly, they should be revisited often so as to imprint their importance deep within our psyche."At TAMMA I work directly with investors to build customized portfolios and plans for people with varied financial backgrounds and goals. Please let us know how we can help your family.

This roller coaster ride is also getting the attention of clients (those who do look at their portfolios, as many do not) recently started asking a few more questions about what was going on. My advice to them was to simply stop looking. Reviewing your portfolio once a month or quarterly is probably all that you would want to do. Looking at your positions more than could trigger the emotions that Josh noted above that could end up doing serious harm to our portfolio and financial goals.I agree with Brown when he went on to say that whatever the next big thing to hit the financial markets is not what is on the front pages of the newspaper today. Brown went on to say "we still cannot pinpoint the events that have marked previous market tops even in hindsight."Another piece of advice that Brown shared was this, "Having a plan in place that’s been crafted in advance – and not just any plan but a damn good one – is superior to any kind of insurance one can buy after the fact. Plans should be agreed upon and adopted during times of clarity and sanity, never under duress. And most importantly, they should be revisited often so as to imprint their importance deep within our psyche."At TAMMA I work directly with investors to build customized portfolios and plans for people with varied financial backgrounds and goals. Please let us know how we can help your family.