The Best College Savings Plan for Parents of Multiples (or Parents of multiple kids)

Most parents may not realize that you have multiple college saving options available to you and your family when it comes to saving for college. But whether you are the parents of multiples (twins, trips, quads, etc.) or have multiple kids, how do you determine what the best college savings plan option is best for you?

What College Saving Plan Options are Available

First, let us begin with identifying what the five college saving plan options are:

- Prepaid 529

- A state Prepaid 529 plan allows you to lock in a tuition rate at in-state public universities. You buy units or credits at participating universities for future tuition and mandatory fees. Each specific state operates its own program and invests these funds to exceed the pace of rising tuition and cover future tuition costs.

- Conventional 529

- It is a lot like a Roth IRA but designed for education expenses at any level, including K-12. Contributions are made on an after-tax basis and grow tax-deferred, and are tax-free when used for qualifying educational expenses. Plans are set up at the state level, but you don't have to be a resident of a state to enroll in its plan. However, most plans offer state residents a state income tax credit.

- Coverdell Education Savings Account

- A Coverdell Education Savings Account is a tax-deferred trust account with similarities to a conventional 529 plan. While more than one ESA can be set up for a single beneficiary, the total maximum contribution per year for any sole beneficiary is $2,000.

- UGMA/UTMA Account

- Uniform Transfers to Minors Act (UTMA) is an extension of the Uniform Gift to Minors Act (UGMA), which was limited to the transfer of securities. Note that while the UTMA offers a way to build tax-free savings for minor children, the assets will be counted as part of the custodian's taxable estate until the minor takes possession. It allows minors to receive gifts and avoid tax consequences until they become of legal age for the state. The UTMA allows for maturity before it is handed to the beneficiary, up to 25 years. The UGMA matures at 18 years.

- Roth IRA

- Typically seen as purely a retirement savings vehicle, a Roth IRA can be used for educational expenses. Contributions (but not earnings) can be withdrawn at any time—income tax and penalty-free.

A Prepaid 529 Plan May Not Sound as Good as Advertised

At first glance, it appears as though a prepaid 529 plan could be the best option given that they provide assurances that your investment will keep up with the rate of college tuition inflation while mitigating the market risk. However, you are a few crucial facts that you need to know:

- You're not locking in today's cost; you are locking in an inflated future cost.

- Because state prepaid plans can only be fully redeemed at state public universities, the program will typically only cover the weighted average of in-state tuition if a student attends a private or out-of-state institution.

- Most prepaid 529 plans only cover tuition and mandatory fees and not other costs, like room and board.

- Prepaid plans have age limitations.

- Other stipulations can include residency requirements and holding periods to use the benefits.

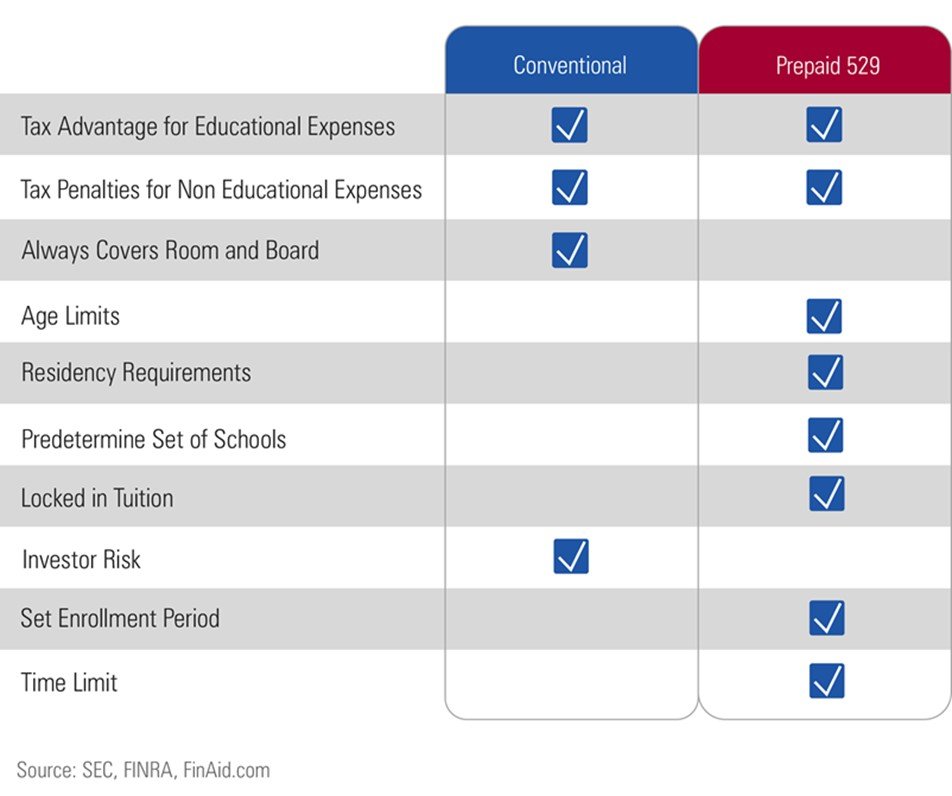

The chart compares a conventional 529 with a prepaid 529 plan. There are currently eight states that offer a prepaid 529 option, which are:

- Florida: Florida Prepaid College Plan

- Maryland: Maryland Prepaid College Trust

- Michigan: Michigan Education Trust

- Mississippi: Mississippi Prepaid Affordable College Savings Program

- Nevada: Nevada Prepaid Tuition Program

- Pennsylvania: PA 529 Guaranteed Savings Plan

- Texas: Texas Tuition Promise Fund

- Washington: Guaranteed Education TuitionProgram

There is also a Private College 529 Plan that allows families to lock in tuition at nearly 300 participating private universities and colleges. It is the only prepaid 529 that can lock in tuition at private universities. The plan is sponsored by the Tuition Plan Consortium LLC, which is composed of participating schools. The Tuition Plan Consortium guarantees the locked-in tuition price, meaning a participating school is obligated to accept purchased plan certificates even if that school later leaves the program. Beneficiaries have up to 30 years to use the plan's benefits.If you are considering investing in a prepaid 529 plan, consider utilizing a checklist that I developed to help you analyze the plan. There are several crucial elements, both financially and personally, that would factor in making your decision to invest in a prepaid 529 plan.If you decide that a prepaid 529 plan is best for you, you are betting that…

- Tuition costs will increase more than you expect the returns on your assets to be,

- Your child will go to an in-state public school, and

- You will be able to continually and consistently pay the monthly, quarterly, or annual plan contribution amount.

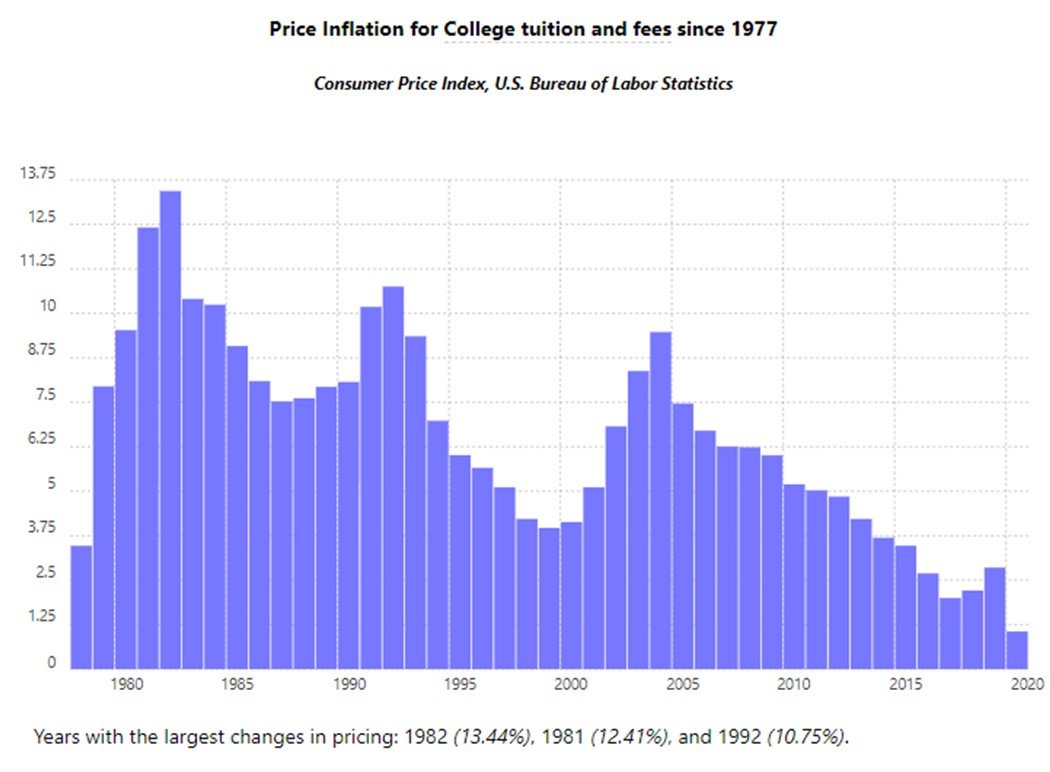

While locking in the cost of tuition sounds appealing, let's look at the trend in the cost of college in the chart below. Notice a trend over the past 15 years? While the absolute cost of college has increased, the rate of the increase has been slowing. Some schools are even seeing a decline in the cost of tuition. As U.S. birth rates continue to decline, this means a shrinking pool of applicants for colleges. Sooner or later, the laws of supply and demand should kick in, thus bringing down the tuition cost.

Notice a trend over the past 15 years? While the absolute cost of college has increased, the rate of the increase has been slowing. Some schools are even seeing a decline in the cost of tuition. As U.S. birth rates continue to decline, this means a shrinking pool of applicants for colleges. Sooner or later, the laws of supply and demand should kick in, thus bringing down the tuition cost.

How Do the Other College Saving Plan Options Stack Up?

Next, let's address the Coverdell Education Savings, UGMA/UTMA, and Roth IRA options as a group. The upside of these three options all pales in comparison to the benefits of a conventional 529 plan. However, there are significant drawbacks to these three options, which are as follows;

- Coverdell Education Savings - Income limitations may not allow you to contribute, there is no state income deduction, an annual contribution of $2,000 is low, compared to what you can contribute to a 529 or Roth IRA, you can only contribute until the child reaches 18, and the account must be fully withdrawn by child's 30th birthday.

- UGMA/UTMA - There is no state income deduction, accounts are considered assets of the child, which means a negative impact on financial aid eligibility, and the assets belong to the child at age 18 or 21, depending on state law and can be used however the child chooses

- Roth IRA - Must have earned income, income limitations that may not allow you to contribute, there is no state income deduction, and the annual contribution is low, compared to what you can contribute to a 529. Roth withdrawals count as income for financial aid purposes and can affect how much aid will be offered

Why I believe the Conventional 529 Plan is the Best Option for Most Families

When it comes down to it, here are the reasons why I believe that a conventional 529 plan is the best option for most families to save for college:

- Flexible contribution options - your not locked into set contributions amounts.

- Ability to choose any school - you are not locked into in-state schools.

- No time or age limitations - you can allow your assets to grow indefinitely with no time table, use the assets when you need them.

- Can be used for all qualified education expenses - prepaid 529 plans cover tuition and mandatory fees only.

- Ease of others to contribute - a significant benefit which I will explain below.

- Depending upon investment returns - allows you to outpace college inflation.

For an in-depth summary of all five college saving plan options, I created a side by side comparison here.Parents often ask me what the impact on financial aid would be in utilizing a conventional 529 plan. Unfortunately, most parents believe that it will negatively impact them, which is wrong.If the parent is the account owner, accounts are treated as assets of the parent, which has a smaller impact on federal financial aid than if the assets were those of the child. The current federal financial aid formula considers no more than 5.6 percent of parents' assets and 20 percent of a child's assets available to pay for college.Individual institutions may consider parents' assets differently when deciding how to distribute financial aid. Be sure to consult the college or university financial aid office and your wealth advisor about your situation.Practically, any college savings could impact your federal financial aid; it should not deter you from deciding to save and invest. Another point that parents of multiples or multiple children should consider is that the more kids you have in college at one time, the lower your Expected Family Contribution (EFC). The more kids you have in college at any point in time is one of the most significant impacts on your federal financial aid.

My Own Family Story

My wife Theresa and I have a set of triplets and another daughter who is 22 months apart. We started our youngest in preschool early, which meant that she had not one, but two years of preschool.She was always trying hard to keep pace with her older set of triplet siblings. We felt that she was mature enough and ready to handle kindergarten as an early 5-year-old.Knowing how the current Expected Family Contribution (EFC) calculation works for college financial aid did play a small role in our decision to let her begin kindergarten early. During a four-year college timespan, I will have three kids in college the first year, four the second, four the third, and only one in the fourth year.We set up 529 plans for each of our kids shortly after they were born. Although we knew that we would not contribute a lot, I knew that something was better than nothing at age zero. I also knew that with the flexibility of the conventional 529 plan, anyone could contribute to it. I strongly encouraged family and friends to consider making contributions for holidays and birthdays to the plan instead of toys or clothing they would quickly outgrow.During the early years, family and friends were contributing more than Theresa and I was. Diapers and formula for triplets were not cheap. Today, college contributions are part of our overall wealth management plan. However, we still don't anticipate that we will be able to cover the entire cost of college, which is okay with us. We know that we must balance other financial priorities, but we also know that we are still helping our kids in some way.

What Can You Do Today?

As I noted in my own story, getting started early and letting compounding work for you and not against you should be your first step.Having conversations with your spouse/partner about how much you can or what to save should be your next step. I work with many families where one spouse/partner wants to pay the entire cost of college while the other does not. I help people find common ground on this issue while considering the other multiple financial priorities that are likely tugging at them.If you have kids who are already in middle school or even high school, start having conversations about college with them now! Setting expectations with your kids as early as possible about how college costs will be covered or shared is vital. I can't emphasize this enough. The last thing that you want is for your kid to get into an Ivy League school only to determine that you can't afford to pay for it.If you have questions about college planning or any wealth planning topic, including portfolio management and tax planning, schedule a time below to see how I may be able to help you prepare for college and other financial and lifestyle goals.