Four Tactics to Get the Most Out of the College Planning Process

If choosing to save for your child's future college education needs is a priority for you, it must be included in your overall wealth management plan. I say choose because you likely have multiple financial priorities, such as retirement, taxes, or other personal savings goals, already tugging at you. Think about being on an airplane; in the event of an emergency, always put the oxygen mask on yourself first and then your child.

The first step in this process begins with having a conversation between parents and children way before you get to the college years. A conversation should include the following;

- What is affordable and what is not,

- What majors can support a given level of student loan debt (if needed) and those that cannot,

- What is a realistic sense of the value a college degree at a specific institution could provide?

While every situation is unique, the next step for parents often comes down to addressing two critical issues;

- How much do the parents want to contribute? Parents trying to answer this question can result in some tense conversations because each parent may have their idea of how much to contribute.

- What capacity do parents have to contribute? While parents might want to add to a college savings plan, it can be difficult with other pressing financial priorities such as retirement, healthcare, and other basic cost of living considerations.

Investment Vehicles to Utilize

If you have made the decision that you want and can save for college, there are many ways that you can accomplish this goal. There are several qualified college savings options to choose from, but I advise clients to consider the following two;

- 529 Plan allows assets to grow tax-free when used for qualifying college expenses.

- IRAs – most people do not realize that they can utilize this qualified retirement plan to use for qualifying college expenses. While there are no penalties to pay, you would pay tax on your earnings; there are ways to minimize your tax exposure when utilizing this strategy.

One of the reasons why I prefer 529 plans is that anyone can contribute to them. I have four small children, which is personally daunting for me to think about when it comes to college planning. However, I encourage other family members to contribute to their accounts on special days like birthdays and holidays, especially Christmas. Those contributions significantly impact the amount my wife and I need to save for their future college plans.

When pressed to deliver a specific number on how much to save, I always tell families something is better than nothing, especially the earlier you start, just like saving for any financial-based goal. A consistent savings approach can be an incredibly impactful solution.

The Power of Consistency and Compounding

The savings aspect of education planning is no different from any financial goal that needs to be planned for. The biggest secret is not a secret; it involves consistency and discipline.

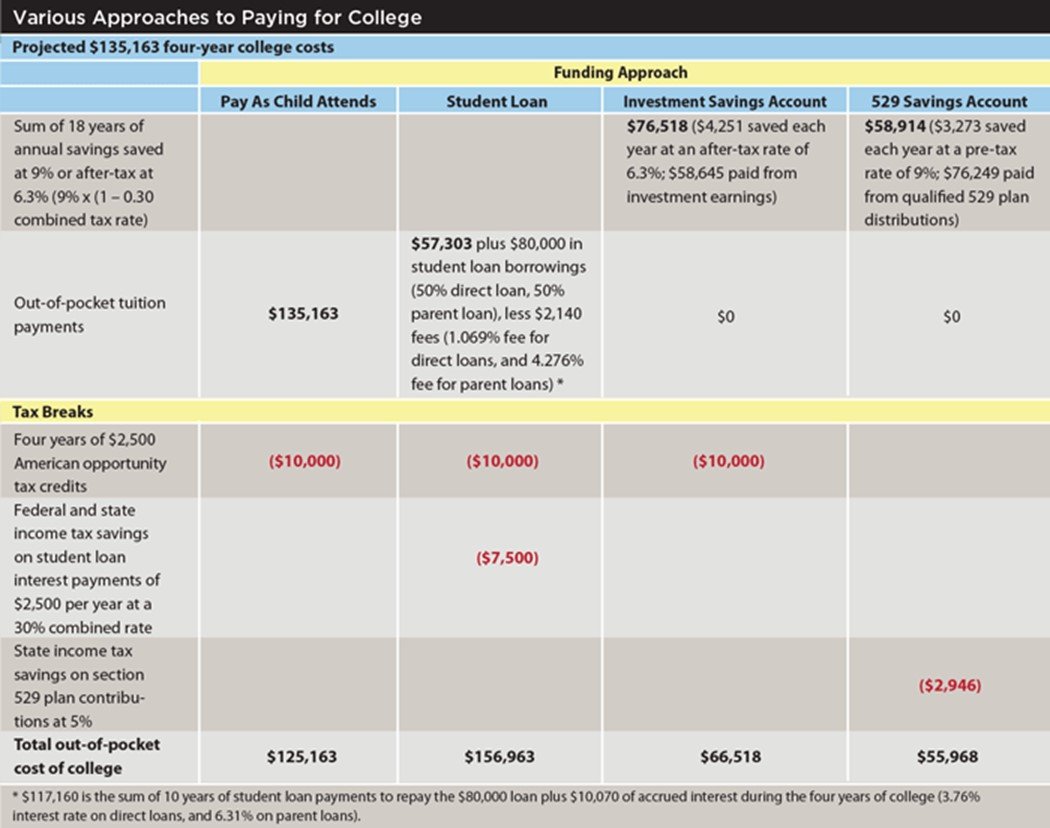

So how much could a consistent savings approach coupled with the discipline required to pull off such a strategy make? The illustration below states that the impact could be worth over $79,000. Put another way, roughly half of the projected cost of a four-year college pegged at today's dollars adjusted for inflation.

Source: Journal of Financial Planning: Recent 529 Plan Changes Add to Their Advantages

This illustration uses an assumed rate of return of 9% and assumes a consistent, steady rate that will likely never happen. This is a known downfall of utilizing planning tools such as this. However, since we cannot predict the future, we must use various assumptions which could be flawed.

Regardless, there is no denying that if you are going to save, save in a tax-deferred vehicle like a 529 plan. As this illustration shows, you will likely need to save less per year while reducing your state income tax.

Applying for Financial Aid

If you have a child who is graduating from high school this year or you are already in college, you need to submit the Free Application for Federal Student Aid (FAFSA). To get the most college assistance, your application must be turned in by March 1. You do not need to pay money to complete the FAFSA. The FAFSA is FREE, so if a website asks you to pay to fill it out, you are not dealing with the official FAFSA site.

For Michigan residents, please see this link for more information about completing the FAFSA form and other forms of free aid for college. Be sure to go to this Sallie Mae site for Scholarship opportunities.

What if You Cannot or Haven't Saved Enough?

If you have not saved enough ahead of time and your household cash flow will not cover expenses, you could take out college loans, borrow from your retirement account, or take out a home equity loan to fill the gap. However, should you?

- How would borrowing from your 401(k) impact your retirement plans?

- Are you willing to work longer to help your child attend their desired school?

- What happens if career or family health issues prevent you from working longer?

- Is a more expensive school worth the extra money, or is a less expensive but comparable school a better bargain?

Taking out loans is an easy way to sabotage your retirement or another component of your wealth management plan. Here are some additional options to consider;

- Choose a school that you can afford.

- Look at community college options with the ability to transfer to a four-year institution.

- Maximize every aspect of the financial aid process. Colleges routinely offer students scholarships and grants as an incentive to enroll, especially those who demonstrate a financial need or who meet academic or other criteria.

- Never be afraid to ask the financial aid office what additional help it can provide.

Lastly, if you need to borrow, stick with federal loans. Interest can be deferred, and longer payment periods can be negotiated if necessary. Parents, remember, you can always get a loan for college, but you cannot get a loan for retirement.

Other Factors to Consider Beyond Saving & the Financial Cost

Perform your own due diligence when learning about potential college options. Utilize independent sources such as the U.S. Department of Education's College Navigator tool, which provides useful information on tuition and fees, financial aid, graduation rates, and more for colleges nationwide. Talk with people first-hand who have first-hand knowledge about the schools your child is considering. Speaking from first-hand experience, nothing can replace an actual campus visit once you have the list narrowed down. I learned this the hard way and wasted my first year of college.

Consider the expenses beyond tuition, room, and board that will add to college costs. Costs include books, school supplies, and transportation, especially if it requires a plane trip for visits home or for you to visit.

A school that's an excellent fit for one student may be a poor fit for another. Some students thrive at large universities, while others do better at small schools. Some students choose a college in a different part of the country, while others would rather live at home while enrolled. Even if everyone you know agrees that State U is the best college around, what's right for your child matters most.

The decision about how much to pay for college will have an impact well beyond the date of graduation and, in effect, may become a decision about your child's financial future, especially if debt is involved, which is the case for most families. Student debt can threaten their long-term financial health, such as planning for their retirement, buying their first home, or even getting their first apartment.

Harvard may be a great place to receive a degree and an honor to be accepted into, but if you are pursuing a career in teaching, going far into debt may not be the best decision to go along with that career choice. The best school is the one that helps your child get to where they want to go in life, even if it means helping them figure out where that might be. College can be a costly place to find one's self. Spending more for a school with a solid reputation but a poor fit for the student is unlikely to provide a good return on your investment. For questions about wealth planning, portfolio management, and tax planning topics, do not hesitate to contact me to find out what options may be best for your family.