How a Family Who Has Triplets Saves for College

My Own Family Story

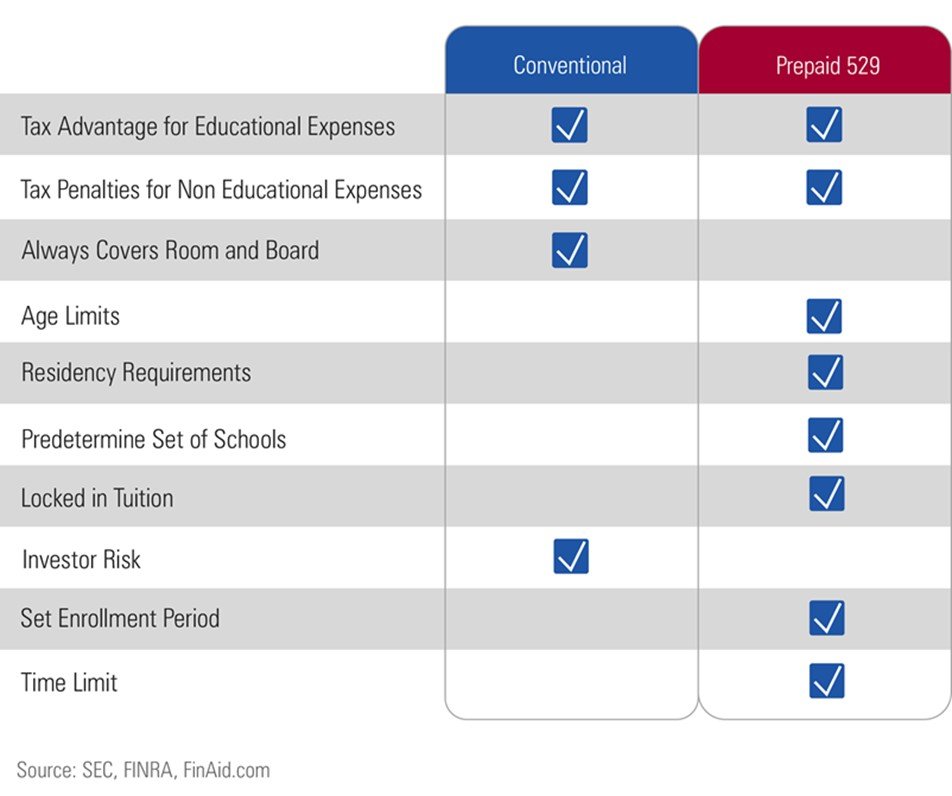

My wife Theresa and I have a set of triplets and another daughter who is 22 months apart. We started our youngest in preschool early, which meant that she had not one, but two years of preschool. She was always trying hard to keep pace with her older set of triplet siblings. We felt that she was mature enough and ready to handle kindergarten as an early 5-year-old.Knowing how the current Expected Family Contribution (EFC) calculation works for college financial aid did play a small role in our decision to let her begin kindergarten early. During a four-year college timespan, I will have three kids in college the first year, four the second, four the third, and only one in the fourth year.We set up 529 plans for each of our kids shortly after they were born. Although we knew that we would not be able to contribute a lot, I knew that something was better than nothing at age zero. I also knew that with the flexibility of the conventional 529 plan, anyone could contribute to it. I strongly encouraged family and friends to consider making contributions for holidays and birthdays to the plan instead of toys or clothing that they would quickly outgrow. During the early years, family and friends were contributing more than Theresa and I was. Diapers and formula for triplets were not cheap. Today, college contributions are part of our overall wealth management plan. However, we still don't anticipate that we will be able to cover the entire cost of college, which is okay with us. We know that we must balance other financial priorities, but we also know that we are still helping our kids in some way.

During the early years, family and friends were contributing more than Theresa and I was. Diapers and formula for triplets were not cheap. Today, college contributions are part of our overall wealth management plan. However, we still don't anticipate that we will be able to cover the entire cost of college, which is okay with us. We know that we must balance other financial priorities, but we also know that we are still helping our kids in some way.

What Can You Do Today?

As I noted in my own story, getting started early and letting compounding work for you and not against you should be your first step.Having conversations with your spouse/partner about how much you can or what to save should be your next step. I work with many families where one spouse/partner wants to pay the entire cost of college while the other does not. I help people find common ground on this issue while considering the other multiple financial priorities that are likely tugging at them.If you have kids who are already in middle school or even high school, start having conversations about college with them now! Setting expectations with your kids as early as possible about how college costs will be covered or shared is vital. I can't emphasize this enough. The last thing that you want is for your kid to get into an Ivy League school only to determine that you can't afford to pay for it.If you have questions about college planning or any wealth planning topic, including portfolio management and tax planning, schedule a time below to see how I may be able to help you prepare for college and other financial and lifestyle goals.