Facing Financial Fears: Your Guide to Managing Investment Risk

Have you ever considered how you'd react in a moment of financial crisis? It's a tough question, right? That's why I believe those risk tolerance quizzes don't capture the full picture.

Investment risk boils down to losing capital when you need it most. So how do you manage this risk? Align the time horizon of your assets with your purpose and financial objectives.

Let's say you're 20 years away from retirement. Does having 100% in bonds seem like the right match for your future needs? Think about it.

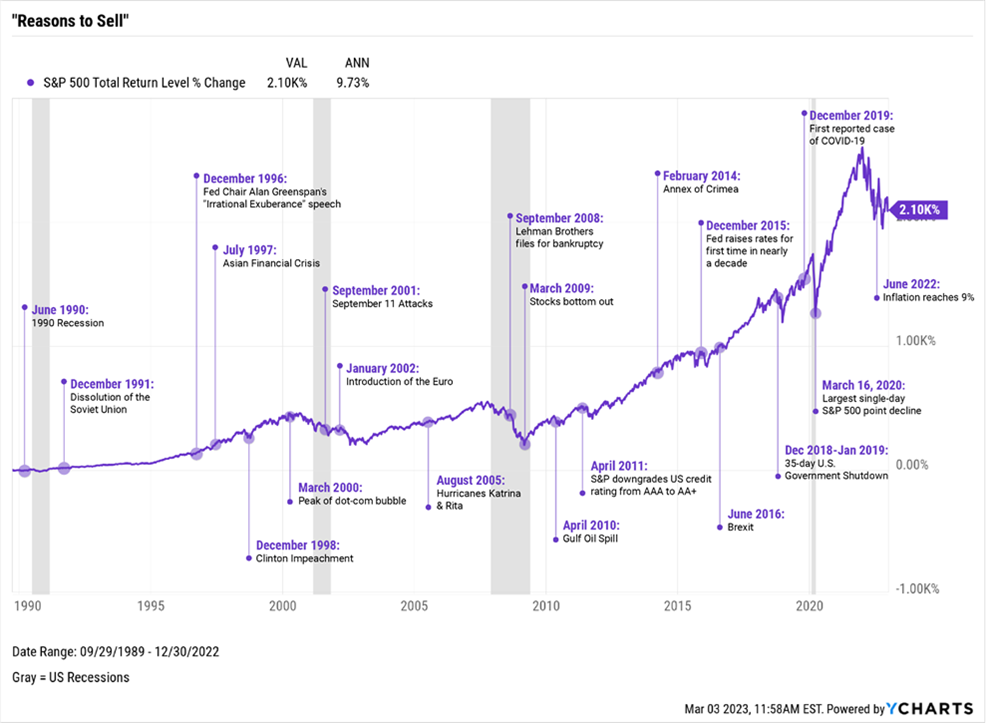

And what about the elusive peace of mind? We all want that good night's sleep, right? Here's a comforting thought: Investment markets have weathered every storm known to humankind and still come out on top.

Remember, our preferences can change rapidly, especially when the economy takes an unexpected turn. Tough times can make us think and act in ways we never thought possible in calmer moments.

Flashback to March 2020 or March 2008 - how did you react? Will you dare to be greedy when others are fearful the next time the markets break?

Here Are a few Solution You Can Utilize

- Diversify your portfolio: Spread your investments across different asset classes to manage risk better. Typically, don't put more than 5% of your portfolio into a single company.

- Establish an emergency fund: Before diving deep into investments, ensure you have a safety net that can cover your expenses for a few months.

- Regularly review your investment strategy: Your financial goals and risk tolerance will change over time. Regularly reviewing your strategy can help you stay on track.

- Consult with a financial advisor: Professional advice can be invaluable in navigating the complexities of investment risk.

Remember, managing risk is all about preparation, diversification, and resilience.

Contact us for a free consultation to discuss your investment risk.