The Latte Factor is Not Going to Make You a Millionaire; Consider This Instead

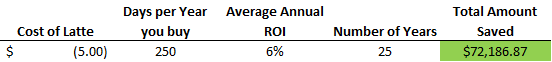

Have you ever heard of a theory called the Latte Factor? The theory goes that if you gave up your $5 a day Starbucks latte and rather invested that money over time, you would reach a sizeable amount of money to help you achieve your retirement or some other wealth management goal.Here is the math on this theory using one scenario: While slightly coming to an amount of over $72k that spans 25 years is nothing to snicker about, it is hardly going to make you a millionaire.Here are some further assumptions that I used and why they aren’t likely to happen:

While slightly coming to an amount of over $72k that spans 25 years is nothing to snicker about, it is hardly going to make you a millionaire.Here are some further assumptions that I used and why they aren’t likely to happen:

- Compounded monthly return – compounding is that magical formula that keeps on giving in the world of finance. It is the rate at which your money grows without you having to do anything to it. I used monthly because you would get a bigger bang for your buck than annually and quarterly, but less than if I would have used daily. The problem with this is that no investment option is likely to pay out a steady gain of 6% annually compounded on a monthly, quarterly, or even annual basis especially if you invest the money in the stock market.

- Length of time to invest – any of these assumptions can be changed (you can email if you would like to receive the simple excel file that I build using this) but I used 25 years given that it is likely a good number to save for retirement. However, do you realize how much discipline it would require not only to save the expense of the latte Monday thru Friday but then to have the extra discipline of not touching the money that you are saving for something else?

Bottom line, you have two major factors working against you; the ability to sustain a constant return over time and the discipline to save and not use the money over time. So if savings $5 on a Latte or some other small daily or monthly expense is not going to make you a millionaire then what will? Paying attention to the “big stuff” might help you reach that millionaire dollar bogie.Below are some examples of big expenses to look out for:

- Buying a house

- Buying a car

- Choosing where to live

- Choosing where and what to do on vacation

- Where you go to college

- Having children

But just as important, here are two big items on the income side which could help you prosper:

- Deciding what profession to enter

- Determining how much time are you willing to invest in yourself to advance your career

While many people would like you to believe that by cutting back on the small things in life will get you to where you want to go in your wealth plan, that is poor advice. People need to focus on making the right financial decisions when it comes to big items in life.The issue is that many people spend more time analyzing the small items such as what big screen TV to buy or what smartphone to go with vs. spending more time analyzing how much you can afford on a monthly rent or mortgage payment.Two key tenants will help you achieve a financial goal, save more, and spend less. While return on investments play some role in helping you to reach a big financial goal such as retirement, these two basic ideas of saving more and spending less is what gets you to the financial mountaintop. However, these two ideas are enhanced with the right financial plan and a strong discipline to follow that plan.