Defining Your Investment Philosophy

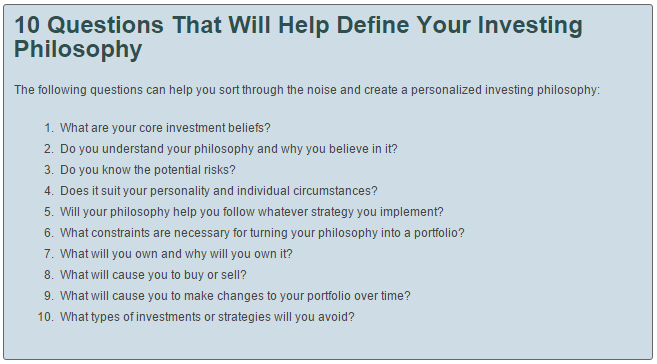

Ben Carlson recently wrote an article for the American Association of Individual Inventors that discussed the process for Defining Your Investment Philosophy. Within his piece, Carlson noted 10 Questions to Help Define Your Investment Philosophy. One of the key tenets of his article is that most investors get into trouble by the constant switching of investing strategies.I believe that everyone has their own unique needs when developing their own investment philosophy, which goes far beyond how conservative or risky an individual may be. An often overlooked question is what exactly are you investing for? I think that answering this question first, would then be a good lead in to the 10 questions below that Carlson identifies in his article that would then need to be addressed.Going back to the switching of investing strategies, continual changes in strategies is likely just as bad or worse than paying higher than average fees which have been proven to have a negative impact on an individual's overall returns. The likelihood of dumping one investment strategy for another is likely root in the lack of a clear answer to what is your investment philosophy.With most situations in life when we have a clear sense of what our goals and objectives are, we can then put together a well-thought-out plan which can be flexibly and adaptable at times in order to reach our final destination.