Loss Aversion and What It Really Means to an Investor

Two constant behavioral challenges that investors face are;

- Remembering loses much more than remembering gains

- The pain of missing out

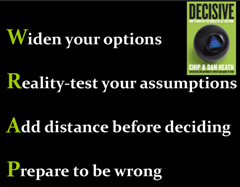

The technical term that we often refer to regarding these issues is called Loss Aversion. A typical investor suffers roughly two times more from a loss than they enjoy from again. In his piece Investing Like a Psychopath, Morgan House states, "We're more likely to remember negative, emotional events than ordinary or positive ones, especially in the short run. That's how it should be: You want to learn to avoid bad things that happened in the past. But it plays a dirty trick on us."WSJ columnist Jason Zweig in his piece The Bull That Got Away, discusses "reframing your regrets and by making gradual changes to your investing plan that are likely to keep you from doing anything rash" to offset the pain of missing out on big investment return. One of the ways that I deal with Loss Aversion to through a concept called Reframing which I was first introduced to last year when I read and hosted a business book club discussion on Decisive by Chip and Dan Heath. The main point to consider with refarming is the ability to Widen Your Options.

- Avoid a Narrow Frame – Teenagers and executives often make “whether or not” decisions which leads to overlooking options, consider the opportunity costs of time or money when making a decision

- Multitracking – consider several options simultaneously, Think AND not OR, multiple options creates a built-in fallback plan

- Find Someone Who Has Solved Your Problem – laddering: look for current bright spots (local), then best practices (regional), and then from related domains (distant), create a “playlists” as a way to generate new stimulus - questions to ask, principals to consult, and ideas to consider