Rent vs. Buy: Which is Cheaper for You?

This is a pretty cool interactive chart from Trulia that helps provide some direction on whether it is better to rent vs. Buy in various areas of the U.S.Below are four key variables that drive the decision

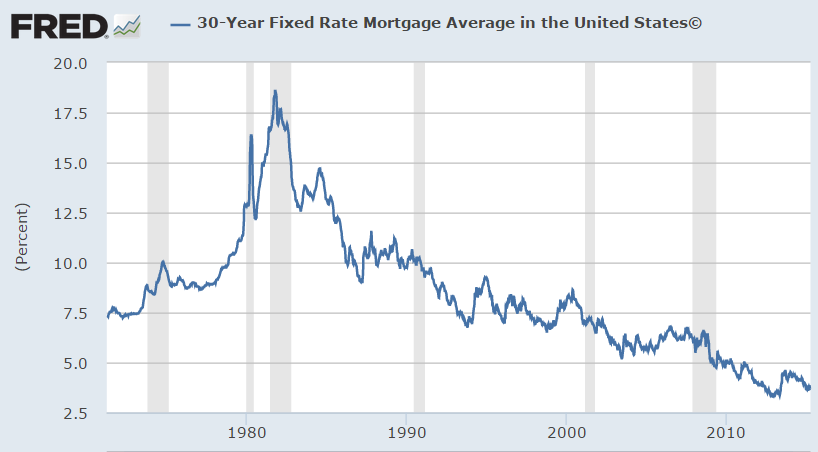

- Interest rate

- Whether you itemize on your tax return

- How many years you would stay in the home

- Do you pay homeowner association fees

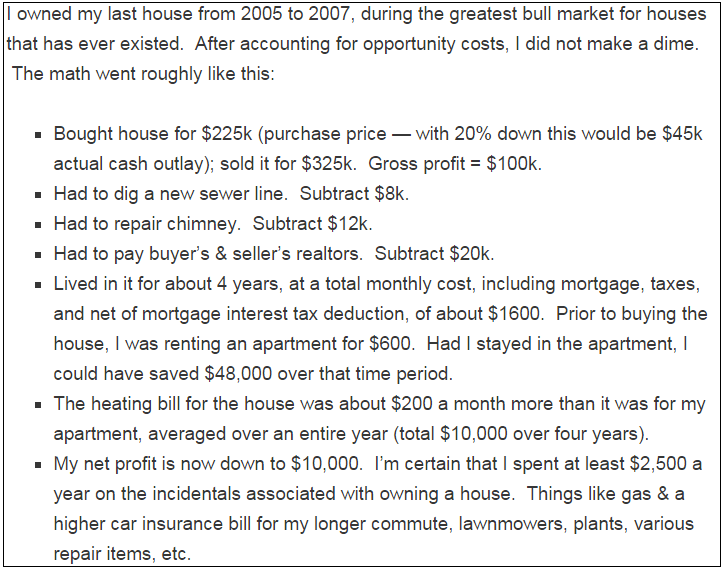

In addition, Ben Carlson had a good post outlining the pros and cons of a 30 year fixed mortgage. Below is an example of how a person made no money on their home but also realize it was a very short period of time that the person actually owned the home.This is why of the four variables I listed above, the hardest and trickiest one to answer is the third one on how long you plan to stay in a home. This to a large extent probably depend upon the type of career that you have. Speaking from someone who has lived in 5 states and moved about 13 times over the past 17 years sometimes you just never know when and where the opportunities will take you.

Speaking from someone who has lived in 5 states and moved about 13 times over the past 17 years sometimes you just never know when and where the opportunities will take you.