What is Financial Wellness and Why it Matters to Your Business

Your employees are juggling multiple challenges. No matter what stage of life they’re in, financial stressors often top the list. Student loans and other debts bog down millennials who are just getting started. Members of Generation X may be in the prime of their careers but are pinched caring for children and aging parents. Baby boomers are preparing for retirement.Most people may know and understand what an employer-sponsored retirement plan is, most common is the 401(k) plan, but most people may not know or understand what a financial wellness program is. Financial wellness is an individual’s ability to make confident, well-informed money-related decisions resulting in financial security for both the short and long term and represent an important pillar of personal well-being.

- Thomas Garman, have been measuring the effects and costs associated with financial stress in the workplace for more than 20 years. Garman and colleagues estimate that the total cost of financial stress in the workplace ranges from 15% to 20% of total compensation paid, including benefits. While additional factors influence productivity, absenteeism, turnover, and healthcare costs, incorporating a financial wellness benefit to reduce the costs associated with financial stress by even 3%-5% can improve a company’s bottom line directly through cost avoidance.

The Objective of Financial Wellness

The success of a financial wellness program should be rooted in the following objectives;

- Reduce/minimize financial stress,

- Established a robust financial foundation, and

- Create an ongoing plan to help reach future financial goals.

Regardless of how you define financial wellness, the focus should always be on how it can help your employees. Given this focus, here are some additional parameters to put around financial wellness objectives;

- Financial wellness should be more than just an online tool. People still want human

- Financial knowledge must support measurable action steps. Showing someone how to create a spending plan, for example, is more powerful than having them read a book about it.

- A seminal research study found that income beyond the $75,000level did not improve happiness. Financial wellness should help guide people on how to utilize current resources better while seeking a balance between living in the moment and planning for the future.

- Building a personal spending plan creates awareness of whether your spending is in alignment with essential life goals. This process helps identify ways to free up extra money for saving, investing, or paying down debt. This awareness can be a motivating factor and potential difference-maker on the path to financial wellness.

According to the 2018 Employee Financial Wellness Survey by PricewaterhouseCoopers, employees want personalized advice from a professional, with the ability to track their progress and accomplishments, factoring in their goals. Additionally, employees identified in-person, one-on-one meetings as the most productive meeting approach, with the highest participation rates.However, group sessions, if it touches on the right topic or is delivered in a way that moves an employee to take action, can be just as powerful.

What Can Employers Do?

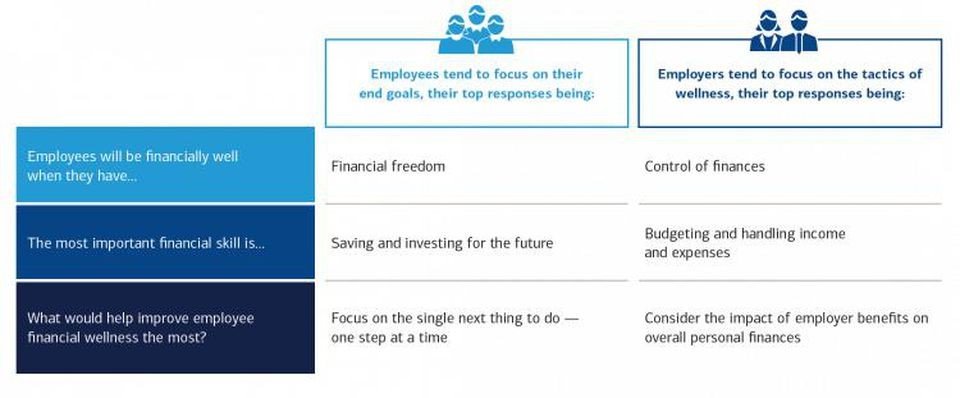

A Bank of America Merrill Lynch Workplace Benefits Report in 2018 surveyed 657 employees who participate in 401(k) plans and 667 employers who offer a 401(k) and a financial wellness program. Employers, the survey found, tend to focus on actions to manage workers’ immediate financial needs, like budgeting and handling expenses. But employees prioritize long-term financial goals, such as ways to help them save and invest for the future. The most effective way for employers to help their employees is to offer services that interest employees in a variety of forums. Mediums that could include;

The most effective way for employers to help their employees is to offer services that interest employees in a variety of forums. Mediums that could include;

- One on one meetings with a professional

- Group meetings on specific financial planning topics

- Phone consultations with a professional

- Monthly newsletter on specific financial planning topics

These methods won’t apply to all your employees, but offering different options should generate more participation than by a one size fits all approach. Especially in a workforce divided by age and gender.

A Solution Beyond Financial Wellness

Most employers may be familiar with an employee assistance program (EAP). An EAP is a work-based intervention program designed to assist employees in resolving personal problems that may be adversely affecting the employee's performance. TAMMA has developed a unique Financial Employee Assistance Program (FEAP).The TAMMA FEAP allows employees to;

- Meet one on one with a Certified Financial Planner® to discuss an array of financial planning related topics that are important to them,

- Gather in a group to cover specific financial planning topics,

- Receive consistent monthly email communication, and

- Can reach a Certified Financial Planner® for support via phone which is convenient for the employee

Additionally, the FEAP can also feature targeted offerings to groups of employees — boomers, Gen Xers, millennials, and women.TAMMA has helped businesses drive positive changes in financial behavior, leading to increased financial wellness, through personalized learning paths, access to trusted resources, and tailored communication to engage individuals.In an era where it is harder to retain and attract talent, an additional benefit such as a robust retirement plan and financial employee assistance program could be drivers that create company loyalty where employees stay through their careers. All while lowering the cost and stress of operating your business.