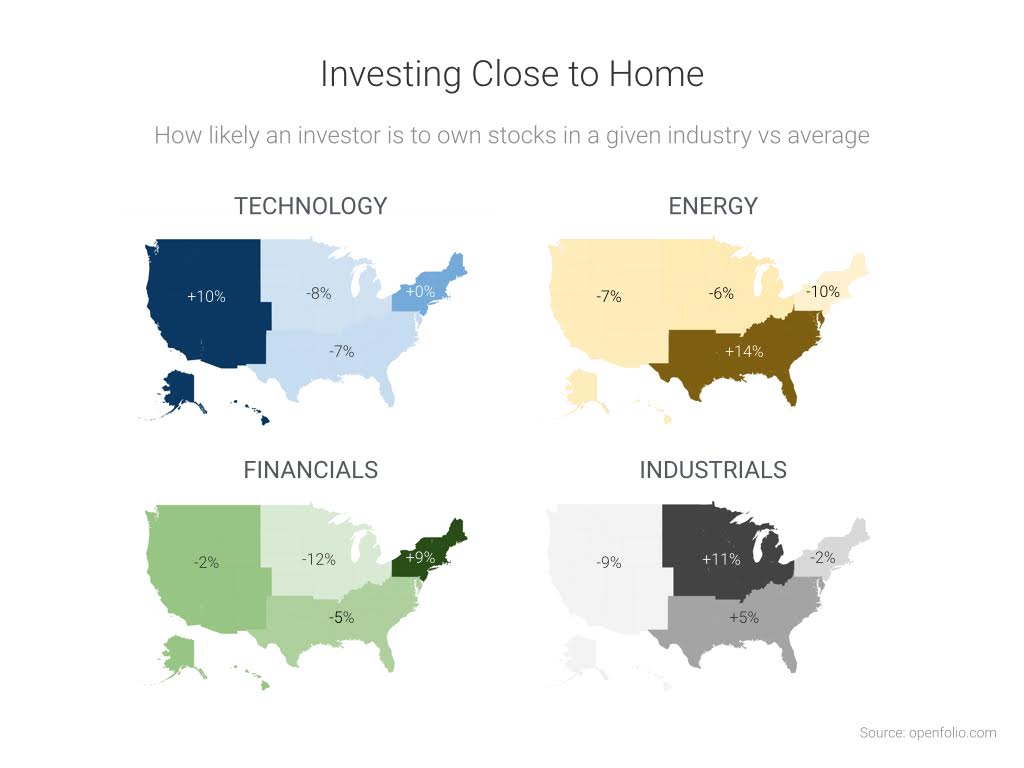

Where You Live Correlates to a 20% Investment Bias

We are always interested in learning more about our investing biases. Hat tip to Barry Ritholtz for posting the graph below.Looking at the list of stocks that I follow, I definitely have a tilt towards the industrials. I think that this is likely not only because I grew up in the Midwest and currently live in MI, but also due to my extensive corporate background working in the manufacturing arena. You have likely heard the phrase "invest in what you know" which was a hallmark trait of legendary investor Peter Lynch. However, I think that having a diverse background and openness to new ideas and industries would serve investors better.One of the key tenets when it comes to investing is that you have to constantly challenge yourself to learn and grow. Consistently reading about new companies and businesses not only helps you broaden your horizons, but it can also still help you strengthen your "invest in what you know" strategy.