Five Options for Parents of Multiples (or multiple kids) to Save for College

Most parents may not realize that you have multiple college saving options available to you and your family when it comes to saving for college. But whether you are the parents of multiples (twins, trips, quads, etc.) or have multiple kids, how do you determine what the best college savings plan option is best for you?

What College Saving Plan Options are Available

First, let us begin with identifying what the five college saving plan options are:

- Prepaid 529

- A state Prepaid 529 plan allows you to lock in a tuition rate at in-state public universities. You buy units or credits at participating universities for future tuition and mandatory fees. Each specific state operates its own program and invests these funds to exceed the pace of rising tuition and cover future tuition costs.

- Conventional 529

- It is a lot like a Roth IRA but designed for education expenses at any level, including K-12. Contributions are made on an after-tax basis and grow tax-deferred and tax-free when used to qualify educational expenses. Plans are set up at the state level, but you don't have to be a resident of a state to enroll in its plan. However, most plans offer state residents a state income tax credit.

- Coverdell Education Savings Account

- A Coverdell Education Savings Account is a tax-deferred trust account with similarities to a conventional 529 plan. While more than one ESA can be set up for a single beneficiary, the total maximum contribution per year for any sole beneficiary is $2,000.

- UGMA/UTMA Account

- Uniform Transfers to Minors Act (UTMA) is an extension of the Uniform Gift to Minors Act (UGMA), which was limited to the transfer of securities. Note that while the UTMA offers a way to build tax-free savings for minor children, the assets will be counted as part of the custodian's taxable estate until the minor takes possession. It allows minors to receive gifts and avoid tax consequences until they become of legal age for the state. The UTMA allows for maturity before it is handed to the beneficiary, up to 25 years. The UGMA matures at 18 years.

- Roth IRA

- Typically seen as purely a retirement savings vehicle, a Roth IRA can be used for educational expenses. Contributions (but not earnings) can be withdrawn at any time—income tax and penalty-free.

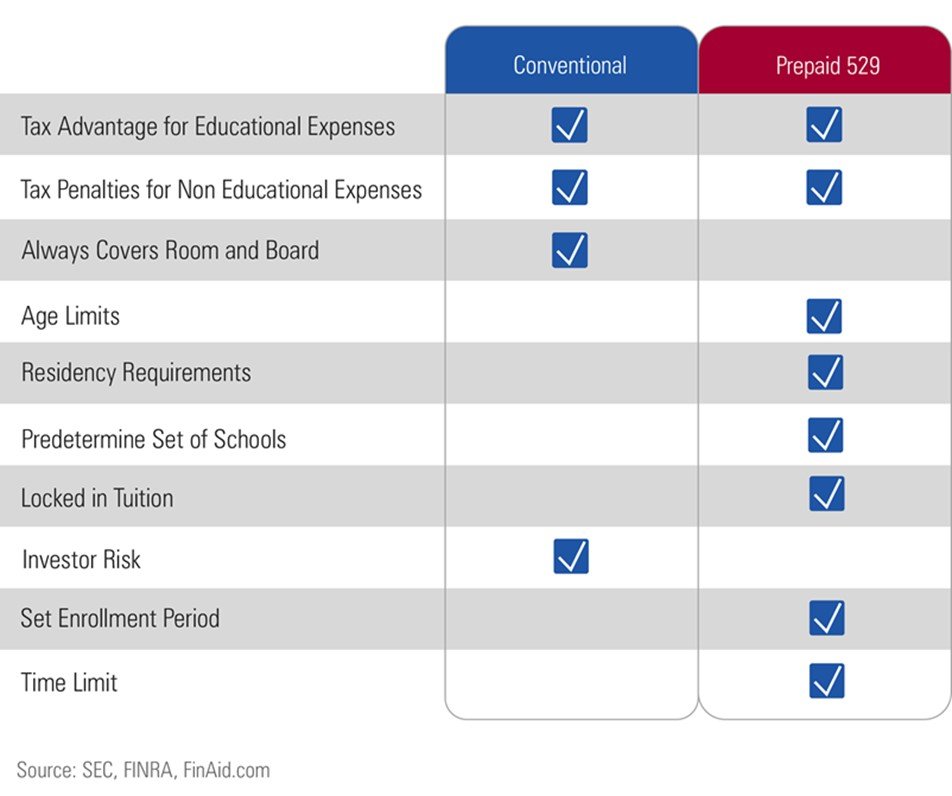

Why I believe the Conventional 529 Plan is the Best Option for Most Families

Full disclosure, my wife and I have a set of triplets and a younger daughter as well and set up individual 529 plans for them when they were born. When it comes down to it, here are the reasons why I believe that a conventional 529 plan is the best option for most families to save for college:

- Flexible contribution options - your not locked into set contributions amounts

- Ability to choose any school - you are not locked into in-state schools

- No time or age limitations - you can allow your assets to grow indefinitely with no time table, use the assets when you need them.

- Can be used for all qualified education expenses - prepaid 529 plans cover tuition and mandatory fees only.

- Ease of others to contribute - a significant benefit which I will explain below.

- Depending upon investment returns - allows you to outpace college inflation.

For an in-depth summary of all five college saving plan options, I created a side by side comparison here.Parents often ask me what the impact on financial aid would be in utilizing a conventional 529 plan. Unfortunately, most parents believe that it will negatively impact them, which is wrong.If the parent is the account owner, accounts are treated as assets of the parent, which has a smaller impact on federal financial aid than if the assets were those of the child. The current federal financial aid formula considers no more than 5.6 percent of parents' assets and 20 percent of a child's assets available to pay for college.Individual institutions may consider parents' assets differently when deciding how to distribute financial aid. Be sure to consult the college or university financial aid office and your wealth advisor about your situation.Practically, any type of saving for college could impact your federal financial aid; it should not deter you from deciding to save and invest. Another point that parents of multiples or multiple children should consider is that the more kids you have in college at one time, the lower your Expected Family Contribution (EFC). The more kids you have in college at any point in time is one of the most significant impacts on your federal financial aid.

What Can You Do Today?

Having conversations with your spouse/partner about how much you can or what to save should be your next step. I work with many families where one spouse/partner wants to pay the entire cost of college while the other does not. I help people find common ground on this issue while considering the other multiple financial priorities that are likely tugging at them.If you have kids who are already in middle school or even high school, start having conversations about college with them now! Setting expectations with your kids as early as possible about how college costs will be covered or shared is vital. I can't emphasize this enough. The last thing that you want is for your kid to get into an Ivy League school only to determine that you can't afford to pay for it.If you have questions about college planning or any wealth planning topic, including portfolio management and tax planning, schedule a time below to see how I may be able to help you prepare for college as well as other financial and lifestyle goals.