Tax Planning is Year-Round; 7 Items that You Should be Checking!

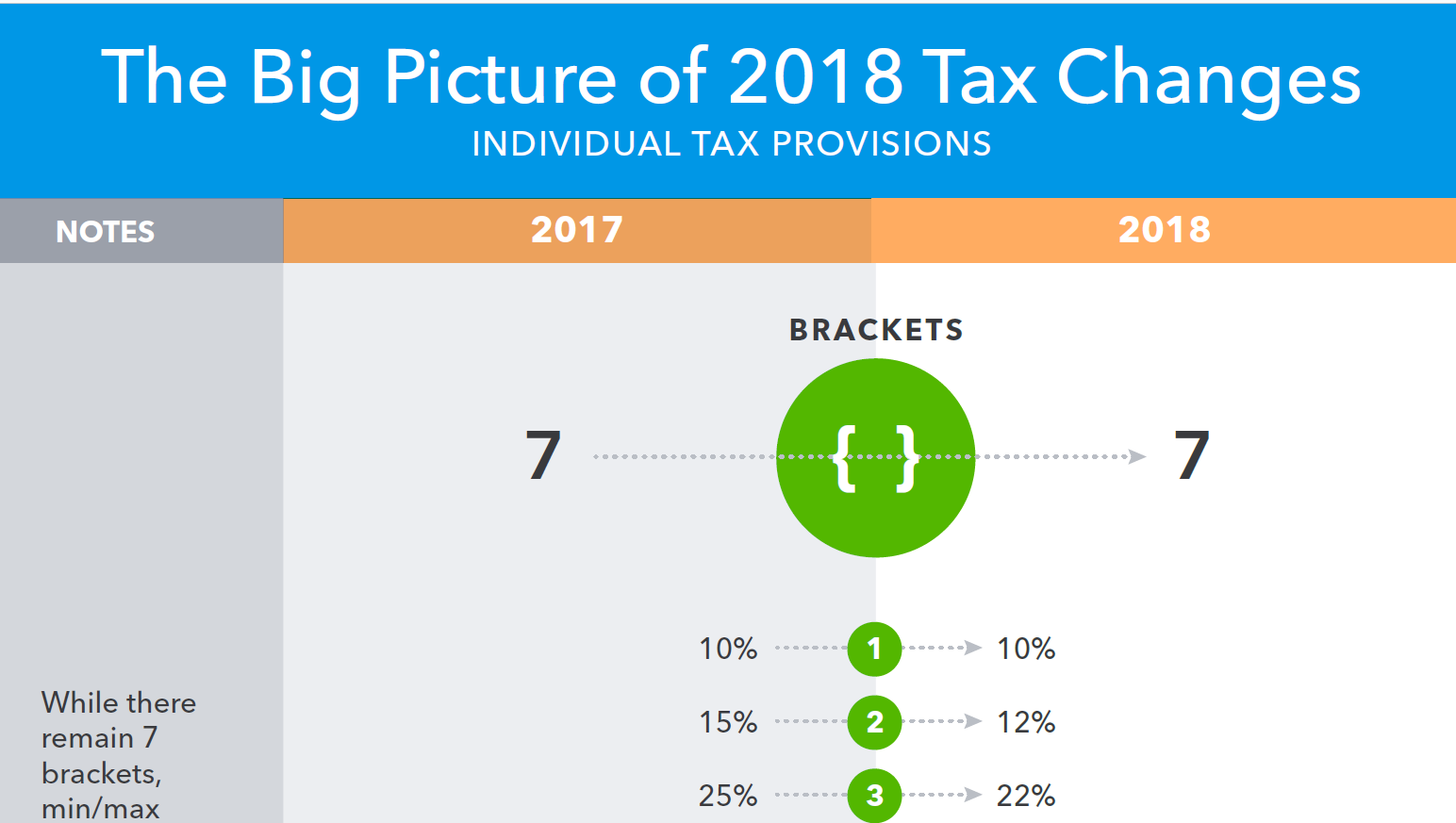

Tax Day has been in our rearview mirror for some time now; I thought that I would provide a refresher on the significant tax code changes that went into place during 2018 with the infographic below.Now would be a good time to examine the following;

- Are you on track to maximize qualified retirement contributions?

- $19,00 for 401(k)s an additional $6,000 for those over age 50

- $6,000 for IRAs with an additional $1,000 for those over age 50

- SEP for Business Owners - up to 25% of compensation, with a maximum of $56,000

- Have you been making charitable contributions or are you planning to make such contributions later in the year?

- If you can contribute to an HSA, are you on track to reach the maximum contribution level?

- $7,900 for families with an additional $1,000 for those over age 50

- $4,450 for individuals with an additional $1,000 for those over age 50

- Have you made any adjustments for the loss of your exemptions which could have a significant impact on families?

- Do you know what the impact will be to changes in your total itemized deductions?

- One key element is the cap on State and Local taxes.

- Have you had the ability to refinance your mortgage to a lower rate?

- Remember that HELOC interest is still deductible if funds were used for home improvements.

- Have you reviewed your taxable brokerage accounts for any tax-loss harvesting opportunities?

For questions about specific tax planning or any wealth planning topic, especially regarding families or your business, do not hesitate to contact me to find out what options may be best for your situation. Select the Infographic to expand

Select the Infographic to expand