Three Factors That Affect Your Social Security Decision

I am often asked the critical question of should I take my social security benefits early or wait until full retirement age or beyond? Issuing a blanket response or answer to that question can lead people down the wrong path, especially on this subject. While many people would benefit the most by waiting until they reach their full retirement age or beyond to collect, several factors need to be addressed to make a decision such as this.Before we get started, everyone should take the time to set up a my Social Security account at the Social Security Administration. Setting up an account is easy, and you get to see more options than the previous paper statements that were mailed. They also have several handy calculators that can be useful in helping to make Social Security related decisions.Let’s begin by looking at the table to the right to determine at what age you are eligible to start receiving social security benefits for retirement is?With your eligibility age in mind, here are some key factors to consider;

- What is the condition of your current health, and what in your family history could impact your health in the future?

- Do you plan to continue to work?

- Are you married?

We will now address these factors one by one and explore their impacts on your decision-making process on claiming Social Security benefits.

Factor 1: Health

Health should be a primary factor in your Social Security and retirement planning. If your health is failing or you believe that you will not survive your average life expectancy, then the option of taking benefits at or before full retirement may be an optimal planning strategy.While there are new types of applications on the market to help you determine your length of life, you are trying to predict the unpredictable at the end of the day. Not to mention, dying is not a topic that most people like or want to think about.Of the three factors that I have laid out, this is the most personal by far, and only you can decide what the best decision for you and your family is.

Factor 2: Continuing to Work

Believe it or not, some people like to work and plan to work as long as possible. Studies show that people who continue to lead active lifestyles, including work, are less prone to chronic health care issues.A growing trend in retirement planning is a semi-retirement or leaving your current career to try something new. Any additional income that you can bring in during retirement can have a significant positive impact on your retirement plan. I cannot stress this point enough because rather than drawing down on your assets, you continue to let your assets work for you and grow through the power of compounding. Thus, increasing your probability of success when it comes to retirement planning.The critical element to consider with continuing to work is how your Social Security benefits could be taxed if you decide to take benefits before your full retirement age. If you are younger than the full retirement age and make more than the annual earnings limit, your benefits would be reduced by the following amounts;

- If you are under full retirement age for the entire year, the SSA will deduct $1 from your benefit payments for every $2 you earn above the annual limit of $17,400.

- In the year you reach full retirement age, the SSA will deduct $1 in benefits for every $3 you earn above the annual limit of $45,360. The SSA will only count earnings before the month you reach your full retirement age.

You can begin to see how careful planning as part of an overall wealth planning strategy is required to help maximize your benefits while minimizing taxes.

Factor 3: Options for Married Couples

The process of trying to optimize your Social Security benefits over a joint lifespan can be complicated. However, you could significantly increase or maximize the benefits you would receive collectively by exploring additional strategies.Start by taking your spouse’s age, health, and benefits into account, particularly if you are a higher-earning spouse. The amount of survivor benefits for a lower-earning spouse could depend on the deceased, higher-earning spouse’s benefit. The bigger the higher-earning spouse’s benefit, the bigger the benefit for the surviving spouse.For spouses with similar work histories and life expectancy, it may make sense for both to delay their benefits up to age 70, if possible. In other cases, especially when there are material differences in work history, it might make sense for the lower-earning spouse to file earlier while the higher earner waits until age 70.The point here is to recognize that there are further claiming strategy options that must be considered to help maximize Social Security benefits for married couples. Again, integrating Social Security claiming strategies within your overall wealth management plan is a critical step to help increase your probability of executing a successful plan.

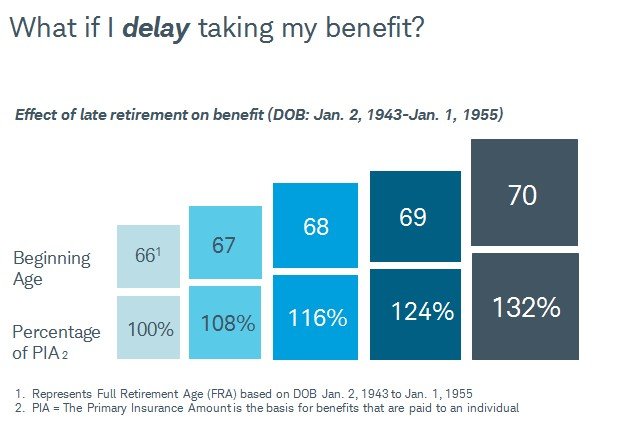

The Financial Impact of Delaying Benefits

Now that we have addressed three crucial factors that should be considered in the Social Security decision-making process, I want to shift your attention to the payoff in delaying benefits. By postponing collecting your benefits, the money you leave on the table each year is a payment for a much higher stream of lifetime income.For every year beyond your full retirement age that you delay starting to collect Social Security, your benefits will grow by about 8%. Delay from age 67 to 70, and your checks will be about 24% bigger. If your full benefits had been $2,000 per month, they would grow to $2,480. That is a meaningful difference of $5,760 over a year. Delaying benefits could also positively impact your taxes, especially if you already have additional income sources to support your retirement. Your income level is the driver behind how much your Social Security Benefits will be taxed.Bottom line, for people who are yearning for more sources of guaranteed income, the strategy of delaying income from Social Security could be especially attractive with a guaranteed return of 8% for each year you delay up to age 70.

Delaying benefits could also positively impact your taxes, especially if you already have additional income sources to support your retirement. Your income level is the driver behind how much your Social Security Benefits will be taxed.Bottom line, for people who are yearning for more sources of guaranteed income, the strategy of delaying income from Social Security could be especially attractive with a guaranteed return of 8% for each year you delay up to age 70.

The Financial Impact of Taking Benefits Early or at Full Retirement Age

Delaying benefits requires leaving sizable sums of money on the table, which, for many sixty-somethings, could be too difficult to do both psychologically or financially. Just like there are many viable reasons for delaying receiving benefits, there are several reasons why some want or need to take benefits early or on time, which could include the following;

- You need the money to live on,

- Failing health or a family history of chronic health issues,

- Psychologically, you want to start collecting what you are owed,

- You think you can outperform the increase you would get by delaying benefits,

- You cannot shake the fear that Social Security will go away.

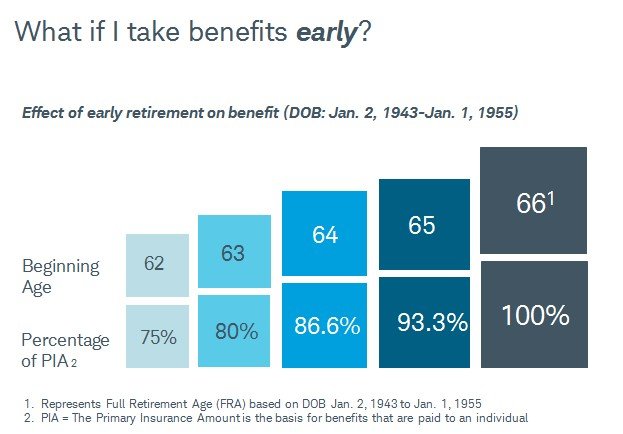

Early and advanced planning could help alleviate some of these issues. Moreover, it would be hard to justify giving up a guaranteed return of 8% annually for the volatility of the equity or fixed income markets when it comes to outperforming the markets.So, what are the financial impacts of taking Social Security benefits early? Here's how it works if your full retirement age is 67, meaning you were born after 1960;

- If you start your retirement benefits at age 62, your monthly benefit amount is reduced by about 30%. The reduction for starting benefits at age;

- 63 is about 25%,

- 64 is about 20%,

- 65 is about 13.4%,

- 66 is about 6.7%.

- If you start receiving your spouse's benefits at age 62, your monthly benefit amount is reduced to about 32.5% of the amount your spouse would receive if their benefits began at full retirement age. (The reduction is about 67.5 %) The decrease for starting benefits as a spouse at age

- 63 is about 65%,

- 64 is about 62.5%,

- 65 is about 58.3%,

- 66 is about 54.2%,

- 67 is 50% (the maximum benefit amount).

The chart provides a good illustration of what the impacts of taking benefits early would be.

Final Decision

There are two very critical pieces of advice that I want to leave with you;

- Verify crucial deadlines and details before applying for Social Security or enrolling in Medicare. What you do not know can hurt you.

- I firmly believe that you should view Social Security as an insurance policy that is an integral piece of your complete wealth management plan.

Multiple factors go into the decision-making process regarding how and when you should claim your Social Security benefits. The process of focusing on and understanding your own unique needs and situation is how you will best arrive at your final decision.For questions about any wealth planning and asset management topics, do not hesitate to contact me to find out what options may be best for your situation.